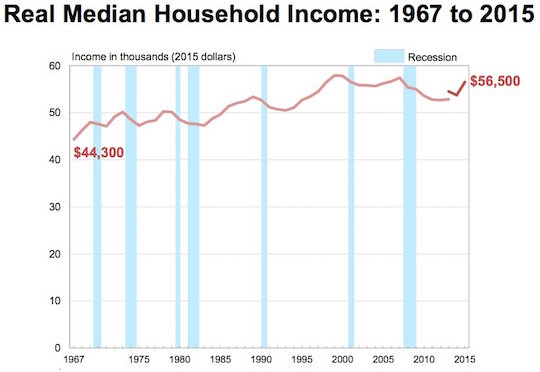

The median income of an American household increased 5.2 percent in 2015, the largest single-year increase since 1967. The poverty rate also fell, and the portion of Americans without health insurance fell to about 10 percent. That’s good news, especially during a recovery whose benefits have disproportionately gone to the very rich and large corporations. The bad news is in the graph above. You will notice that median incomes have risen after the each of the seven recessions of the last 50 years except for two: the last two. Although the historical trend has been for incomes to exceed or at least return to their pre-recession levels during each recovery, the median income is still lower than it was in 2007 or, for that matter, 1998.

Tag Archives: median income

Home prices make Missoula a great place to charge other people to live

The median price of a home in beautiful Missoula, Montana has gone up $53,000 since 2011 and now sits at a quarter million dollars. Meanwhile, median household income holds steady at $47,029. On a 20-year mortgage, the median household must pay 38 percent of its income to live in the median house. On a 30-year mortgage, they pay almost exactly 30 percent. Renters, whose median incomes are much lower, can put 30 percent toward mortgage payments and get a $145,935 loan. There are currently 25 homes listed on Missoula Trulia below that price. Eight of them are auctions.

Missoula has a housing shortage, and it’s working on a permanent underclass. Now that home prices have reached a record high despite low wages, Missoula has become the perfect place to charge other people to live. Whether you sell your house to Californians or put it on our four-percent-vacancy rental market, you’ll find there’s no better place to own a home you don’t live in.

If you insist on living in your house, the all-time high property taxes that happen to coincide with all-time-high home values and all-time-same wages make the deal less sweet. But we can’t have everything. In fact most of us can have very little, and houses aren’t on the list. You can read all about it in this week’s column for the Missoula Independent, which has already won me free attacks on my character from realtors. I’ll match honesties with any motherfucker in a red jacket, anytime.

Pew: Wealth gap between young and old at all-time high

Around here we occasionally take swipes at the Baby Boomers, alleging that they have, for example, constructed a culture around catering to their own narcissism that they now blame for everything. But the real objection to the boomers is that there are so many of them. That’s why so much TV in the 1980s was about the 1960s—or simply about being thirty—and why in August we declared that a 66 year-old had the best body in the world. It’s also one reason why it’s so difficult for a person my age to buy a home, and probably why half the country insists we cut all functions of government except Social Security, and maybe why the financial services industry dominates the economy and Congress. The Baby Boomers bought all the houses and made all the money and voted in all the congresspeople already, and now they are enjoying a well-deserved lockdown on society after five hard decades of mere dominance. If all this sounds like unsourced complaining to you, consider the news from the Pew Center that, in 2009, the gap in wealth between young and old reached an all-time high.

Richard Florida points way to permanent conservative majority

Say what you will about the Tea Party; they are all wearing ball caps and sunglasses. Also they participate in a rhetoric of violence.

As part of his ongoing research into how much mileage you can get out of one sociological theory, Richard Florida has produced this terrifying examination of statistical conservatism in the United States. Props to “Mirko” Mike Sebba for the link. If you’re excited to see which states are more conservative than others, I urge you to close your eyes and visualize them right now, because you will be exactly right. Mississippi is the only state where more than 50% of respondents in a Gallup poll identified as conservatives, with a gang of mini-ssippis—North Dakota, Arkansas, Louisiana, South Dakota and South Carolina, where nobody really followed up on why this happened—close behind. Does that list seem familiar to you? That’s right: they’re the suck states.

Slate’s Timothy Noah on income inequality

Slate is midway through what is threatened to be a two-week series on income inequality in America, just in time for the controversial announcement that the President will not try to solve the economy by giving more money to rich people. Timothy Noah looks at several putative dangers to America’s middle class, including immigration, racism/sexism, and computers, none of which accounts for the growing gap between rich and poor in the United States. That gap is enormous. Currently, the wealthiest 1% of Americans take home 24% of the national income. Between 1980 and 2005, more than 80% of the nation’s considerable increase in earnings went to that 1%. To put that in perspective, back in 1915—the era of the Carnegies, Vanderbilts and Rockefellers, as well as a generation of non name-brand robber barons—the top 1% only got 18%. Economically, ours is a less equal America than that of our great grandparents.