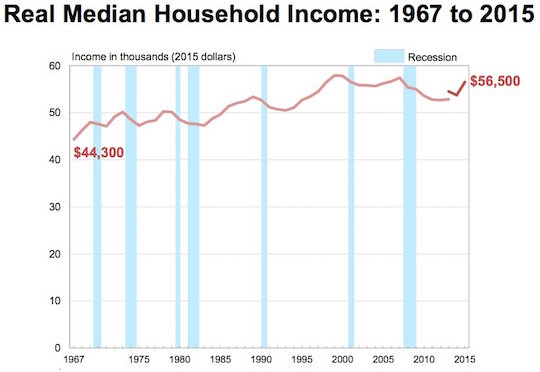

The median income of an American household increased 5.2 percent in 2015, the largest single-year increase since 1967. The poverty rate also fell, and the portion of Americans without health insurance fell to about 10 percent. That’s good news, especially during a recovery whose benefits have disproportionately gone to the very rich and large corporations. The bad news is in the graph above. You will notice that median incomes have risen after the each of the seven recessions of the last 50 years except for two: the last two. Although the historical trend has been for incomes to exceed or at least return to their pre-recession levels during each recovery, the median income is still lower than it was in 2007 or, for that matter, 1998.

Category Archives: financial reform

Why does Bitcoin require arbitrary work?

Over the last few days it is possible I have become fixated on Bitcoin, a cryptographically controlled virtual currency that presently exchanges at around $800 per. By “presently” I mean this morning. If you are reading this in 2014, odds are the value of Bitcoin has done something surprising, as the chart above suggests it might. Bitcoin has been extremely susceptible to market fluctuations since its creation in 2009. Part of that volatility owes to Bitcoin’s gradual acceptance as currency; until 2011, Bitcoins traded for exactly zero dollars, because you couldn’t use them to buy anything. Now, though, several legitimate retailers accept Bitcoin, and so do a lot of illegal ones.

Game day for financial reform

It’s Monday, and politics nerds across the nation are waking up and shouting, “Let’s get ready to increase federal oversight of financial markets and/or ruuuuuummmbbblllllllllllleeee!” directly into the ears of their spouses or cats. It’s go time, motherhumpers, and Broadway Chris Dodd is going to throw the long bomb (regulation of derivatives markets) down the sideline (gray area separating conventional banks from hedge funds they operate) to hit Chuck Schumer in a curl route (narrative of Republican obstructionism) in the hopes that he can run it into the end zone (future in which Argentinian-style currency collapse has not forced us all to do weird Japanese pornography to pay our electric bills.) It seems like the game day metaphor is breaking down now—not least because the Patriots have decided not to show up. You know who the Patriots are, right? They’re the Republican party, defenders of Real America, whose concern for Main Street has led them to promise a filibuster against the attempt to regulate Wall Street. And the Combat! blog staff has been tailgating since 6:30, too. Put your shirts back on, interns.