Oh man: we’re just 36 hours away from the thrilling conclusion of the 2014 campaign season, when the voters of America will once again exercise total control over their governments. On an unrelated note, I enjoyed this article about the First Tuesday Luncheon Series, in which Republicans members of The Financial Service Committee meet “lobbyists from banks and insurance companies” for a monthly book club. One member of the committee picks the book, and everyone who shows up to discuss it donates to his campaign fund. Remember to vote tomorrow, so that the members of The Financial Services Committee do what you want. Otherwise, they’ll have to fall back on the paid lobbyists with whom they formed a book club.

Category Archives: corporatocracy

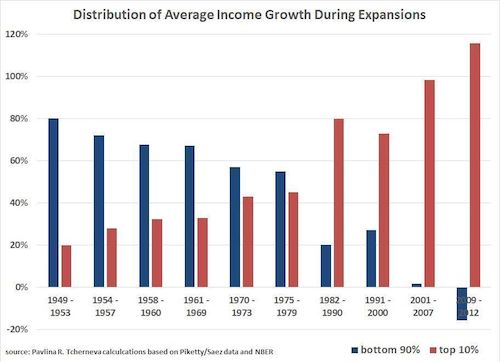

Income growth since 2009 has gone entirely to richest 10%

The Bard University economist Pavlina Tcherneva has calculated the distribution of income growth during periods of economic expansion, and her results suggest that recovery from the financial collapse of 2008 has been limited to the top 10%. It appears that more than all of the income growth since 2009 has benefited the richest tenth; during our glorious recovery, inflation-adjusted incomes have fallen for 90% of Americans. And don’t even get me started on 2001-2007, the period of wild growth in the finance and real estate sectors that set the stage for 2008’s crash. We saw six years of growth whose gains went to the richest Americans, followed by a jobless recovery that enriched them further at everyone else’s expense.

FCC reverses stance on net neutrality

Tom Wheeler and the FCC have changed their position on net neutrality, drafting new rules that would allow internet service providers to charge companies for faster delivery of their content. Finally, Comcast and Netflix will get a chance to make some money. Wheeler strenuously denies that his agency is “gutting the open internet rule,” but it’s hard to see this decision making the internet a more equitable place. Perhaps it will be exactly as free and egalitarian as before. Or maybe we are not totally crazy to worry that letting Comcast—which owns NBC and Hulu—buy TimeWarner Cable, owned by AOL and what used to be Warner Bros., will result in some kind of collusion.

ALEC model bill makes taping farm cruelty an act of terrorism

Earlier this month, the fifth of five Butterball employees pled guilty to criminal animal cruelty, in the culmination of a two-year investigation that began with the activist group Mercy For Animals covertly taping mistreatment at a North Carolina turkey farm. A Department of Agriculture veterinarian, Sarah Mason, was convicted of obstruction of justice for tipping off a friend at the Butterball farm just before they were raided. On the same day the last Butterball employee pled, North Carolina state senators introduced the Commerce Protection Act, a bill making it illegal to videotape farm conditions that is modeled on ALEC’s Animal and Ecological Terrorism Act.

Too big to punish?

The City of Baltimore has filed a lawsuit in Manhattan federal court, alleging that banks deprived the city of millions in investment income by conspiring to fix the London interbank offered rate. Stay with me. Like all aspects of banking except robbery, the Libor is extremely boring. It is the benchmark interest rate at which banks loan money to one another, and it provides the basis for interest calculations on a variety of investments, loans and other financial instruments. When the Libor goes up, banks pay more for cash flow loans, and some investments yield more. When it goes down, banks pay less and some investments yield less. According to Peter Shapiro, an advisor to Baltimore and other municipal investors, “about 75 percent of major cities” have lost money due to Libor manipulation.