If you want your name to live forever in politics, come up with a reason why helping rich people is good for everybody. That’s what Arthur Laffer did in 1974, when he drew his famous curve on a napkin. The Laffer Curve illustrates the theory that lowering tax rates can sometimes increase overall tax revenues by stimulating economic growth. This argument makes sense, as far as it goes, but it doesn’t tell us much. To many people, though, the Laffer Curve means that cutting taxes raises revenue. That’s the argument Treasury Secretary Paul Mnuchin made this week to justify President Trump’s plan to dramatically reduce corporate taxes. Won’t lowering taxes add to the deficit? Nah. “The tax plan will pay for itself with economic growth,” Mnuchin said. Well then. That sounds fortuitous.

Tag Archives: laffer curve

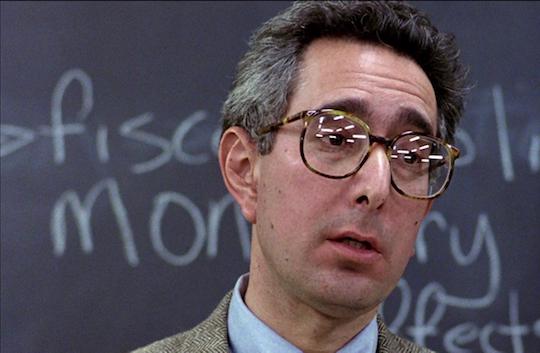

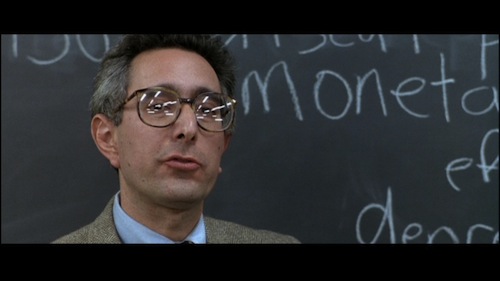

Something d-o-o economics. Voo-doo economics

John Smick sent me this excellent column by Martin Wolf on the political genius of supply-side economics. For those of you who did not hire me to help you prepare for the US History SAT II, supply-side economics is the theory that the best way to foster economic growth is by making it easier for people to produce (supply, natch) goods and services—primarily through reducing taxes on the rich and deregulating industry. Ostensibly, the increased economic activity generated by these policies offsets the decrease in revenue caused by the tax cuts; one gets 17% of $8 trillion rather than 34% of $4 trillion, and everybody wins. In practice, that’s never happened. Proponents will tell you that’s because supply-side economic policies have never been consistently implemented for a long period of time, but it might also be that the whole thing is hooey. Still, while the economic value of supply-side economics has yet to be demonstrated, its political value to the Republican Party is so significant as to have made it an article of faith.