John Smick sent me this excellent column by Martin Wolf on the political genius of supply-side economics. For those of you who did not hire me to help you prepare for the US History SAT II, supply-side economics is the theory that the best way to foster economic growth is by making it easier for people to produce (supply, natch) goods and services—primarily through reducing taxes on the rich and deregulating industry. Ostensibly, the increased economic activity generated by these policies offsets the decrease in revenue caused by the tax cuts; one gets 17% of $8 trillion rather than 34% of $4 trillion, and everybody wins. In practice, that’s never happened. Proponents will tell you that’s because supply-side economic policies have never been consistently implemented for a long period of time, but it might also be that the whole thing is hooey. Still, while the economic value of supply-side economics has yet to be demonstrated, its political value to the Republican Party is so significant as to have made it an article of faith.

Part of the advantage of supply-side economics lies in its simplicity. The solution to virtually any economic contraction is to cut taxes, which happens to be a message everyone wants to hear. That the infamous Laffer Curve tends to suggest giving the biggest tax breaks to the rich is a generally underplayed detail, as is the part about letting BP dump a billion gallons of crude oil into the ocean with impunity. Fortunately, corporate donors and extremely wealthy individuals—the backbone of GOP fundraising—know that part already, and the rest of the country just hears that they’ll get to take home more of their paycheck. From a messaging standpoint, it’s the killer app.

When Pete Sessions goes on Meet the Press and says “cut taxes” and “empower private enterprise” fifty times, he’s talking about supply-side economics. If he’s a little fuzzy on the details, it’s because supply-side has never accumulated any empirical evidence that it actually works. The theory is debatable and the proof is zero, which makes supply-side policies somewhat tricky to defend.

This combination of political expedience and logical fragility has elevated supply-side economics to the level of religious precept among contemporary Republicans. The wealthy vampire wing of the party will always love it whether it works or not, since they get the tax cut up front. The rest of the GOP is left with a principle that is extremely useful for winning elections but may not, you know, have any ground in truth.

As a result, tax cuts and deregulation have gradually shifted, in Republican rhetoric, from the realm of economics to the the realm of morality. Since Reagan, tax cuts for the rich have been about letting Americans “keep what they earn,” while welfare and similar social programs—a much more efficient way to stimulate the economy, since welfare recipients are much more likely to spend all the money they get—are an instance of lazy people letting the rest of us work for them.

That may be true. It bears not at all, however, on the question of how best to maintain stable growth in a post-industrial economy, since a 6% increase in GDP caused by 30 million welfare queens deliberately breaking the condom is better for me than a 2% increase caused by hard-working industrialists keeping their profits. By making supply-side economics into a moral argument—an issue of free enterprise rather than deregulation, and of rewarding innovation rather than giving a tax break to the hyper-rich—the GOP has managed to sidestep the issue of whether it works entirely.

This approach is unsurprising from a party that has, since the 1980s, branded itself in terms of religion, patriotism and authenticity. All of these are moral principles, and they ask for a kind of reasoning that puts the conclusion first and looks for arguments second. Once you believe that America is a Christian nation and God wanted us to invade Iraq, it’s a short trip to thinking that the progressive income tax is immoral and the Laffer Curve works—even though no one has ever seen it do so. It’s religious thinking applied to the secular sphere.

There’s nothing moral about protecting the rich at the expense of the poor. As Martin Wolf points out, Republicans are in a win-win situation with supply-side economics: if it works, they’re right, and if it fails the government will accrue such a deficit that it has to cut social services. Sound familiar? That the Republican Party’s universal economic solution comes with no evidence to back it up is bad enough. That they have made such a politically cynical position into an article of faith is perverse.

Excellent post, particularly where it intersects morality and political expediency. It boggles my mind that, given the mega-super computers around today, we can’t plug in the data and figure out what works best using some kind of modeling. We can put a satellite on an asteroid twenty million miles away but we have no clue how best to spend and / or save money to stimulate growth. Sheesh.

As Smick says, this is an excellent post and I would forward it to my Dad but for the fact that you referred to the “Man Who Defeated Communism” as “Reagan” instead of “Saint Reagan,” “The Best President Since Lincoln,” or, well, “The Man Who Defeated Communism.”

However, you call corporate donation the “backbone” of the GOP election machine. True enough. But let’s not pretend its only them. Corporations can afford to pay for two backbones. The following is from The Economist (http://tinyurl.com/econ-GOP-DEM):

“August was the best money-spinning month so far for the presidential candidates. In that month both men beat their fund- raising records.

“John McCain’s campaign, heartily boosted by Sarah Palin, brought in $47 million. But Barack Obama raised $66 million, more in a single month than any candidate for political office in America’s history.

“Obama has helped to change the direction of corporate giving. By late July, the political action committees of American companies had contributed almost $214 million to the Democrats and Republicans. For the first time in over two decades, the cash was evenly divided: Each party received roughly $107 million.”

I’m pretty grateful human nature is less predictable than the rotation and velocity of an asteroid.

Of course the secret of supply-side economics is that it doesn’t raise revenues and more importantly isn’t even supposed to do so. It’s just a bad faith argument. As Reagan’s budget director David Stockman publicly admitted in 1981, the real objective of supply-side policy is to lower taxes for the wealthiest Americans and hopefully damage revenues enough to force social spending cuts (“starve the beast”). It was supposed to reverse redistributive government policies–literally, to take money from the poor to give to the rich.

In the end “starve the beast” failed because it isn’t feasible for the government to cut services to the necessary extent, which led to deficit spending. Fortunately other facets of economic neo-liberalism, particularly the outsourcing of manufacturing and the breaking of unions, realized the dream of regressive economics. Real income for most Americans has stagnated for about 30 years even as it rose spectacularly for a tiny minority of top earners, to the extent that the USA now has the most unequal distribution of wealth since statistics began to be kept in 1929. Success!

It seems like the argument for supply side economics is Laffable indeed.

Please, next, the moral complexities of Present Discount Value. The sophohistorical necessities of declining hegemony. The unanswered and hardly asked last question of Classical Economics: The End of Growth. The normative assumptions of half-baked social sciences codified by iterations of policymaking and social neurology, illustrated by analogy to monotheistic influences on cultural artifact and psycholinguistics.

I’m not so dismayed by the embrace of Supply Side economics by the Right as I am by the embrace of Classical Economics by Western Civilization. It’s a flawed, nascent theoretical framework with the predictive power, at its best, as Emily Dickinson at her best. Troubled by The Economy? Blame the bones of our common discourse. Classical Economics is designed to end like this. It’s a normative system, clung to as a positive system because it’s too mindboggling and/or dispossessing to imagine anything else. Political expediency is correct; but it’s not enough to say that. It’s social expediency. It’s academic and intellectual expediency. It’s myopia.

More is not always better, and “Rational Action” is most properly understood as a euphemism for shortsightedness. Anybody who tells you that the market is the solution for a market-based problem doesn’t have an honest understanding of economics.

^^^What’s the old saw about the economist on the desert island? “Let’s assume that we have a can opener…”

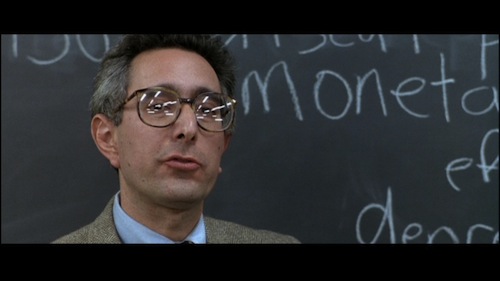

Great post. I had never considered how ironically cast Ben Stein was in FBDO.