In the comments section of yesterday’s post about Generation Opportunity’s campaign to get young people to “opt out” of Obamacare by not buying health insurance, Myeh posted a link to this Craigslist ad for a “patriotic but weird Uncle Sam.” The ad seeks a male with “street theatre experience” to wear the Sam costume for a “conference of young activists” in Chantilly, VA. Sure enough, Generation Opportunity is based in Virginia, and they’re launching a tour of 20 college campuses later this month. Their message? The individual mandate doesn’t mean that you, individually, have to get health insurance. You’re better off getting nothing and paying the fine.

First of all, don’t take a job that requires you to wear a costume and pays $275 for two nine-hour days. That’s just over $15 an hour, and I suspect they don’t offer benefits. Second, the GenOpp campus campaign is designed to counter the numerous activist groups, such as EnrollAmerica, that are encouraging college students to sign up for state insurance exchanges. All Generation Opportunity wants to do is inform students about the pluses and minuses of getting health insurance under the Affordable Care Act.

“What we’re trying to communicate is, ‘No, you’re actually not required to buy health insurance,’” Generation Opportunity President Evan Feinberg said. “You might have to pay a fine, but that’s going to be cheaper for you and better for you.”

That’s a pretty loose construction of “you’re not actually required to buy health insurance.” Buying health insurance is not a requirement in the same sense as, say, falling toward the center of Earth when nothing is under you, but it is mandated by law. And while the $95 fine is cheaper than health insurance, it is maybe not as valuable from a services-per-dollar perspective.

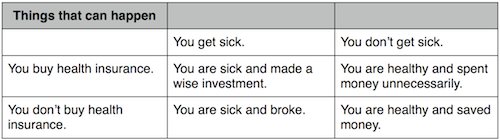

Feinberg declined to say how paying a hundred bucks to get nothing was better for college students than paying several hundred bucks to get health insurance. In this case, “better” may refer less to personal well-being than to broad societal outcomes, possibly related to freedom. So let’s examine some outcomes using this handy chart:

As you can see, the worst-case scenario for buying insurance—healthy and blew a couple grand—is far better than the worst-case scenario for not buying insurance, sick and blew several grand. If there were some mechanism available by which people could pay $200 a month and guarantee that they would not get sick all year, we would want everyone in America to do it.

Contrary to what your girlfriend says about astragalus, that mechanism does not exist. The next best thing, from a societal standpoint, would be to mitigate the effects of sickness in such a way that, yeah, people still coughed or had Hodgkins lymphoma or whatever, but they got the proper treatment and its cost was already paid, or at least built into the health care/insurance economy.

The individual mandate is, from one perspective, a grotesque imposition on personal freedom. From another perspective, though, it is an attempt to get everyone who participates in the American health care system to acknowledge that they personally can get sick.

When a 27 year-old breaks his leg and can’t pay his emergency room bill, the rest of us pay for it just as much as when a 47 year-old does that. The difference is that the 27 year-old is A) more inclined to prioritize short-term savings over long-term safety and B) less likely to have money in the bank when that decision backfires. Young people may be less likely to get sick than everybody else, but they’re also more likely to be uninsured and in worse financial trouble when they do.

So again we cannot escape the sensation that Generation Opportunity is spending $750,000 to do something bad for society. It’s bad to convince young people not to buy health insurance. It’s bad for the other people in the risk pool, who have to pay higher premiums right away and, probably, more for urgent care down the line. It’s bad for the college students themselves, a certain percentage of whom will suffer financial catastrophe when they get sick.

And whom is it good for? In a broad sense, I suppose it’s good for the Republican Party, since they might see the dread Obama humiliated on a national-historic stage. But even that seems like a petty victory. The Affordable Care Act passed three years ago. It’s as if Napoleon, three years after the Battle of Waterloo, spent a million dollars encouraging French people to contract typhus and cough on the Duke of Wellington. There must be some angle to convincing young people to make bad decisions that hurt the country in order to humiliate a lame duck President, but I cannot see what it is.

I would hope our government is taking 100% of the revenue from that ‘no insurance’ tax penalty and putting it into the health system.

The central problem with our health care system is that it’s employer based, and the worst thing about The Affordable Care Act is that it further entrenches this whack-ass system by requiring many employers to provide company health benefits. Most people have literally no clue how much their insurance costs, because it’s hidden behind a salary that pretty much is what it is. In general though, the only way to get healthy people to jump into a health care pool with the infirm is to obfuscate just how much they are spending to subsidize the old, the sick, and stupid babies.

Basically what I’m saying is we should have single payer or whatever the european mumbo jumbo is called.

Captain, you’re right about the way employment conceals health care costs, but I’ve wondered lately (probably naively) if the delay of the employer mandate could fix that. If a company pays $10,000 a year for an employee’s health insurance and sees that the same employee could get coverage on the new individual marketplace for $6,000 a year, wouldn’t all parties have a strong incentive to drop employer coverage, split the savings, and send more healthy folk into the exchanges?

Companies would save money, individuals could actually shop for competitive coverage, and profits could go back to salaries and dividends instead of being gobbled up under the table by health-care inflation. I’m probably missing some tax implication or other, but I still wonder if all the hysteria from the right is out of fear that this really could be a boon for businesses and individual alike. The government has been gathering revenue for 4 years and it’s about to start injecting it back into the economy very shortly. The initial projections for marketplace plans are already cheaper than a lot of employer-provided plans. And in the absence of an employer mandate … why wouldn’t the whole market shift this way?

I think the market IS shifting that way, with major employers dropping health care coverage. This should help make American businesses more competitive, globally. And it would put more healthies into the pool.

The downside? Having to pay to pay for one’s own insurance.

Welcome to my world, folks.

I recall a lot of talk of some fortune 500 companies considering dropping health coverage, but did any actually do it? They certainly weren’t thinking of giving back the value of that ‘benefit compensation’. When I worked at Verizon Business this was something like $17,000/year per employee.

Those large companies have a lot negotiating power, and I would think their employees and those on medicare were the only ones getting a reasonable deal on health care in the last couple decades.

I know very little what the real outlook is, but I have a hard time imagining a family will be able purchase equivilant health insurance on the exchanges for less than what their employee benefits cost.

Regardless the company has to make the decision to drop benefits and increase salaries by some amount that will allow them to buy an equivilant plan for themselves and their dependents. Ignoring a lot of other factors, that would seemingly only happen if the exchanges have greater negotiating power than the company.

It will also be hard for me to believe this will provide a beneficial outcome to those with families, unless the company would pay out more of the money pool to those who have dependents, or unless the exchanges provide large discounts for families. I mention this because the majority of people have dependents, and thus they would have to be on board with the plan for any change to be affected.

So compare the $17,000/per employee spent by Verizon (tax-free) versus the latest CBO estimates for a Silver plan on the exchange: $4800. I don’t know if exchange premiums can go in a tax-sheltered HSA or not (I’d be surprised if they didn’t), but even if they didn’t, there’s more than enough difference to compensate both employer and employee.

I don’t think having to buy your own insurance is a downside at all; it’s one step closer to a national risk pool and a kind of backdoor single-payer system. Even considering the most cynical outcome — that big employers will cut off benefits and pocket all the savings for their shareholders — employment and health care could still, finally, be de-coupled and the most needy can still prevail on subsidies.

Two other benefits: the labor market loosens up and a massive cash infusion hits the business sector. All it would take is for HR departments across the land to sit down and show the basic arithmetic above. If I recall, a part of the ACA now requires payroll to list the cash value of your insurance benefit on your paystub and W-4.

is that $4800 per person? If so a family of 4 doesn’t really benefit. Another question is whether the silver plan provides similar deductables and co-pays to my old verizon plan, which I can’t remember what the details of because I never used it being young, healthy, and single. If it does, then that’s great. I just don’t believe it.

I just don’t see how these exchanges would provide a better deal for people that had good insurance before. They are intended rather to allow people that were getting screwed because they had no company benefits to get a reasonable deal.

Also I think businesses over a certain size had to pay a penalty if they didn’t provide a company plan even before obamacare. If that’s true it would have to figure into the calculation.

I hadn’t heard of some earlier mandate or penalty. All I know is that the CBO numbers are punching in lower and lower. The $4800 above is a national average for individuals, but it does not follow that each individual in a family would cost x-times that figure. The latest figures show a family of four, making $50k a year, paying something like $79/month on the low end -the most salient variable being geography, evidently.

In any case, the whole point of the ACA was to create a market place where none existed before, with the hope that market competition could finally exert some downward pressure on cost. Insurance companies are wildly inefficient administrators of health care and can only make money by enforcing geographic fiefdoms and denying coverage to sick people. They also benefit by keeping their premium increases under the hood of employment benefits packages. The ACA makes the cost more transparent and provides an active marketplace to compare it to. If the numbers keep coming in as low as they do and buyers get decent coverage for it, we could have the opposite of the “death spiral” on the exchanges. Businesses and individuals would both have stong incentives to go there.

But this is all a hope, of course, and your point about deductibles and co-pays is well-taken. After all the “keep your government out of my Medicare” hoo-ha I wouldn’t be surprised if people find a way to resent having better and cheaper coverage.

This is a great tip particularly to those new to the blogosphere.

Brief but very precise information… Appreciate your sharing this one.

A must read article!