Former Secretary of the Treasury and gifted face-maker Larry Summers has calculated how much more middle-class households would make if the United States enjoyed the same income distribution it had in 1979, and the results are startling. According to his calculations, households in the bottom 80% of incomes would be making another $11,000 a year, on average, if we had experienced the same economy of the last 35 years without the growth in inequality. Households in the top 1%, on the other hand, would get $750,000 less. If you’re having a hard time wrapping your head around those two numbers, NPR’s Planet Money podcast has produced a helpful graph. Scroll down to see the whole thing—like six screens down.

Tag Archives: middle class

Times: US middle class no longer word’s richest

The New York Times is running stories about inequality, and they are running hard. Today brings news that the American middle class is no longer the richest in the world. Our hardworking suburban football fans were tied with Canada’s hockey-gazing layabouts in 2010, and data suggest we’ve been surpassed since. Our poor—families at the 20th percentile of US income—make substantially less than families in Canada, Sweden, Norway, Finland and the Netherlands. But those are all socialist countries. Our working poor may not have as much money, but they have freedom. In the decade since “freedom” became the most important word in American rhetoric, per capita income has shrunk at the 40th, 30th, 20th, 10th and 5th percentiles.

So are we going over that cliff?

Now that the election is over, those of us who try to discern the future via myopic readings of news events—as opposed to via objective analysis of quantitative data, like a jerk—have to find something new to conjecture about. Fortunately, by which I mean to our grave misfortune, there’s that fiscal cliff. If Congress does not reach a deficit-reduction agreement by the end of the month, it will trigger massive automatic cuts to domestic and military spending that coincide with the expiration of temporary tax cuts to wreck our economy. Or Congress can decide that won’t happen, since they’re the ones who put the sequester in place to begin with, but we’re going to pretend that’s not an option. They need to make a deal. What that deal might look like has gotten a little clearer, maybe, depending on how you read this.

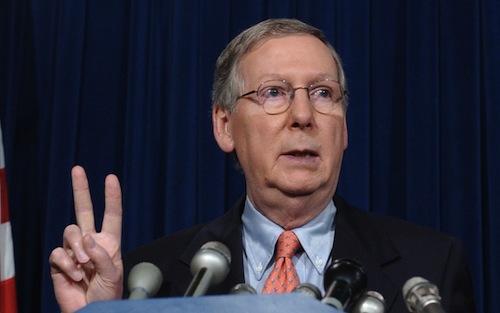

McConnell says he’ll block any tax package without cut for top 2%

Shortly after House Republican leader/medium-market weatherman John Boehner signaled his willingness to consider an extension of the Bush tax cuts that excludes the wealthiest 2% of Americans, Senate Minority Leader Mitch McConnell has said he’ll block any such package. Speaking on the floor Monday, he opined that “only in Washington could someone propose a tax hike as an antidote to a recession.” Like much of what the senator from Kentucky says, that statement is technically honest. Under current law, the Bush tax cuts will expire in 2010. Letting them lapse—either by not voting to extend them, voting to extend them for everyone but households making over $250,000 a year or, say, filibustering the vote to extend them—would therefore constitute a tax hike, in that some or all taxes would become higher than they are now. Of course, by that reasoning, McConnell is proposing a tax hike as an antidote to the possibility that his party might compromise with a Democratic President. Only in Washington, indeed.